Hello!

My name is Mike, the creator of Dividend Stocks Rock and owner of the very successful blog, The Dividend Guy Blog. I started investing in 2003 in natural resources & mining stocks with $0 in hand and a line of credit of $20,000.

My name is Mike, the creator of Dividend Stocks Rock and owner of the very successful blog, The Dividend Guy Blog. I started investing in 2003 in natural resources & mining stocks with $0 in hand and a line of credit of $20,000.

During my first three years of trading, I accumulated a $50,000 down payment, net of debt, for my first house. I then converted my strategy to a dividend growth portfolio in 2010. Those who follow The Dividend Guy Blog have seen my results so far, but if you don’t know the blog, you may want to dig a little bit more into my mind prior to deciding if this strategy is the right one for you. The purpose of this page is to share with you the seven dividend rules I follow to succeed on the stock market. I linked to all sources used for further reading.

I used to struggle with the same issues millions of small investors deal with on a daily basis. Which stocks to buy? When to sell them? How to find the time to manage my portfolio? How to diversify? I wasn’t into dividend investing until looking at my portfolio returns in depth to realize I was having difficulty keeping up the with the market. The root of the problem was a very poorly built portfolio that lacked structure and the components required to build a sturdy base. I made good money from the stock market but I was taking unnecessary risk to achieve my investing goals. From that point on, I was determined to create a portfolio strategy that would allow me to benefit from dividend growth stocks as a solid foundation.

We all ask ourselves the same questions…

Which stocks to buy?

When to sell them?

How to diversify?

How to find the time to manage my portfolio?

I’m not exactly following the buy & hold strategy recommended by many dividend investors. I like to build a core portfolio of stocks I would probably never sell but I also like trading a few more stocks in and out to make a healthy profit. Imagine if you could still invest actively in individual stocks while building a rock solid portfolio. Imagine if you could use the fundamental principles of investing without getting bored or having to read hundreds of pages of stock research.

Dividend Stocks Rock (DSR) follows the same dividend growth model I use to manage my own portfolio. I didn’t come up with these investing rules out of the blue. Each rule has been written after these four years of trading dividend stocks, reading through many financial research publications and listening to top investors and portfolio managers’ wisdom.

Principle #1: High Dividend Yield Doesn’t Equal High Returns

Principle #2: Focus on Dividend Growth

Principle #3: Find Sustainable Dividend Growth Stocks

Principle #4: The Business Model Ensure Future Growth

Principle #5: Buy When You Have Money in Hand – At The Right Valuation

Principle #6: The Rationale Used to Buy is Also Used to Sell

Principle #7: Think Core, Think Growth

Dividend Stocks Rock Principles

The first question that comes to mind as an investor is: why choose dividend investing over all the other investing strategies used by investors? In 2011, Ridgeworth Investments highlighted the main benefits of dividend investing:

Corporate Finance Health. The dividend evolution of a company is a transparent image of the company’s ability to generate wealth for its investors over time. Dividend growth is a direct translation of management’s confidence in the company’s future.

Significant Source of Total Return. From 1926 to 2011 Dividend paying stocks are responsible for over 43% of the S&P 500 returns (source JP Morgan Asset Management). Therefore, almost half of your total return is found in dividend payments.

Important Impact on Stock Returns. Research has proven the impact of a dividend announcement. On average, a dividend increase pushes the stock higher by 2% (Aharony and Swary,1980), a dividend initiation increases the stock value by over 2% (Michaely, Thaler & Womack, 1995) and a dividend cut decreases the stock value by 9.5% (Healy and Palepu, 1988).

Lower Relative Volatility. Have you ever heard of the expression “getting paid to wait”. During bearish markets, dividends are like a buffer to your portfolio valuation. While the value of your stocks fluctuate, you still receive your dividend payout which reduces your portfolio volatile.

Higher Returns Regardless of Interest Rate Movements. Bonds holders think they hold safe securities until the day the FED raises its interest rate. Then, they realize bond values can drop as fast as a stock in a market crash. With interest rates at their lowest, dividend stocks become a great solution for income dependent investors.

Okay, now you know why to look for dividend paying stocks. But which kind of dividends should you aim for? High yield? What about Dividend Growth? Which kind of payout ratio is reasonable? Here are my answers to these questions.

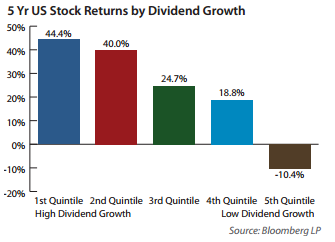

High Dividend Yield Doesn’t Equal High Returns

Some investors look for the highest dividend yield possible. Did you know that the highest dividend yield stocks underperform more “reasonable” yielding stocks? The Hartford Mutual Funds company wrote:

“The study found that stocks offering the highest level of dividend payouts have not performed as well as those that pay high, but not the very highest, levels of dividends.”

Following this principle, I usually aim for dividend yields over 2.50% but under 5%. During a bullish market, I’ll even start being cautious with stocks paying over 4% in dividend yield. I’ve done my own research and even built a case against high dividend yield.

Focus on Dividend Growth

Beyond dividend yield, there is dividend growth. To be honest, the dividend yield doesn’t matter to me. I even picked stocks with yield as low as 1% (Disney:DIS) for example. What really caught my attention is management’s will to increase this payout year after year. Here’s an interesting quote from Saturna Capital:

“Indeed, dividend growth has been a much larger determinant of equity returns in this new era of low benchmark rates and higher levels of uncertainty.”

At DSR, we look at dividend growth over 5 and 3 years. We ensure both metrics are positive to ensure that management is dedicated to return more wealth to investors over time. This is also a great indicator of management’s confidence in the company’s future. In addition to including dividend growth stocks in our DSR portfolios, we also provide a list of Pure Dividend Growth stocks updated weekly.

Find Sustainable Dividend Growth Stocks

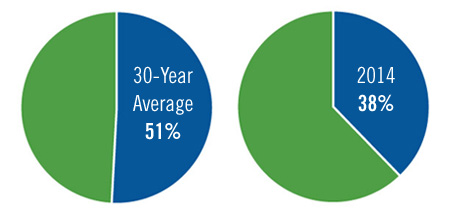

Since 2009, companies have been very careful managing their payout ratios. The dividend payout ratio tells you what percentage of the earnings per share (EPS) is used to pay the dividend. In an ideal world, the dividend payout grows at the same rate as the EPS in order to keep the same payout ratio. We can see that recently, companies have grown their EPS faster than their payouts:

Dividend Payout Ratio of Stocks in S&P 500 Index 30-Year Average vs. 2014, period ended June 30, 2014

Source: Compustat via FactSet. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

This graph shows us there is plenty of space for more dividend increases in the future if you select the right stock. Companies included in our portfolios show a payout ratio under 80%, most of them have a payout ratio under 65%. We want to make sure companies not only continue paying their dividend but will also increase it in the future.

This covers which type of dividend stocks you should look for. But the dividend payout is only the result of a sound business model. There are other metrics to consider prior to buying a dividend stock. These metrics are linked directly to the company and not its payout.

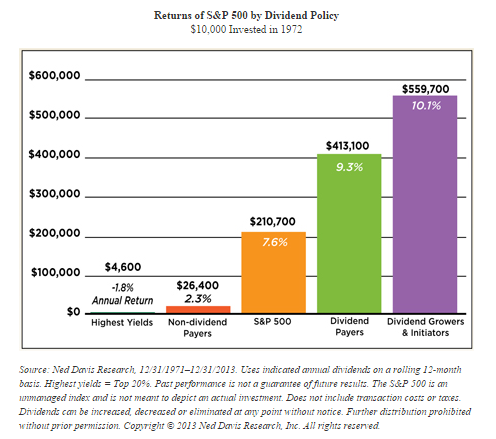

The Business Model Ensure Future Growth

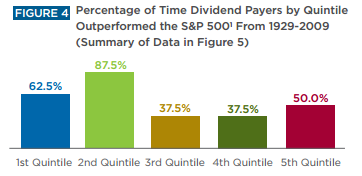

When you think about what the dividend truly represents for a company, you quickly understand it’s the “extra money” left in the bank account once all profitable projects have been funded. Instead of leaving this money sleeping in a bank account, the company can generate more interest in its stock by distributing dividends. Businesses which pay dividends and increase them will outperform other stocks:

Now how can you find these marvels? This is why you need other financial metrics to identify companies that will be able to sustain and increase their dividend for the next 10 years. At DSR, we look at the 3 and 5 year metrics for Sales and Earnings per Share (EPS) growth. We only select companies showing positive growth on both the 3 and 5 year periods. Since an economic cycle lasts between 5 and 8 years, a strong company should be able to post increasing sales and earnings over these periods.

DSR STOCK METRICS

3 year revenues = positive

5 year revenues = positive

3 year EPS growth = positive

5 year EPS growth = positive

Why look for these metrics? Technically, you can’t expect to pay dividends if you don’t make money (earnings per share). Following the same train of thought; it’s impossible to continuously increase dividend payouts without increasing the EPS. But in order to increase the EPS, you need to increase your revenues (sales). The more sales, the higher EPS (if your margins are positive of course!). And the higher the EPS growth, the higher the chances of seeing an excess of cash flow converted into a dividend increase.

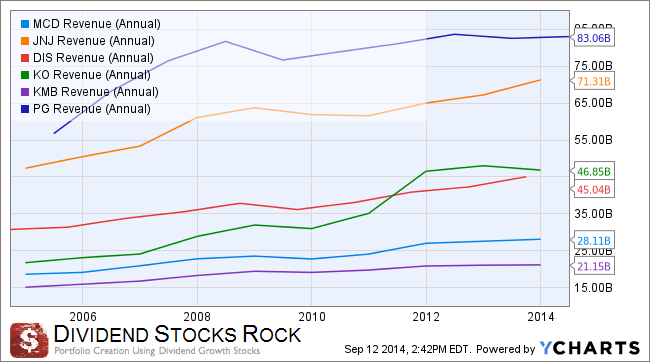

The reason why I don’t require a 5% or 10% growth or the one year data on both metrics is to avoid discarding strong companies running into small bump in the road. As you can see in the following graph, many great companies will experience a rough year of sales:

This doesn’t mean they are not good companies to include in your portfolio. It is important to keep in mind that revenues can’t always climb higher every year and it’s only normal that there are small, temporary declines in sales. The first 4 dividend investing principles are not the ingredient of a magic formula that will guarantee your investing success. However, it will help you focusing on the right stocks. Overall, I follow 7 investing principles that have been proven and provided me with great returns since 2010, the year I started to pick dividend stocks.

Since 2012, I’ve announced my stock results online and I beat my benchmark each year. This means I not only made money in a bullish market, but I’ve made more money than the index I’m comparing with. The majority of my Dividend Stocks Rock portfolios are also beating my benchmarks.

If you want to learn more about those 7 investing principles, you can keep reading and find out about what Dividend Stocks Rock has to offer. If you have read enough and want to start using Dividend Stocks Rock, you can select the DSR membership option that suits your needs and benefit from our 30 days no question asked refund policy:

DSR PRO$399/year9 DSR Portfolios w/ Trade Alerts

Dividend Safety Score

425+ Stock Cards with Ratings

DSR Weekly Newsletter

Stock Report on Demand

Customized Quarterly Report

Your Holdings Ranked

Sector Allocation Analysis

Exclusive buy & sell listDSR Yearly$199/year9 DSR Portfolios w/ Trade Alerts

Dividend Safety Score

425+ Stock Cards with Ratings

DSR Weekly Newsletter

25% Rebate on the monthly subscription DSR Monthly$22/month9 DSR Portfolios w/ Trade Alerts

Dividend Safety Score

425+ Stock Cards with Ratings

DSR Weekly Newsletter

Buy When You Have Money in Hand – At The Right Valuation

One of the most debated questions among investors is definitely when is the right time to buy a stock. There are many ways to determine the “perfect time” to add shares to your portfolio. Most of them are just gimmicks to take money out of your wallet. At DSR, we would rather buy stocks when we have the money available. Sleeping money is always a bad investment. There are always great opportunities on the stock market. In 2014 for example, there were nice buying opportunities in February, April and August:

But let’s be honest, each time we hit these headwinds, we start reading about dozen of reasons stocks would continue to go down. In January, results weren’t as high as expected, then we heard it was the end of the party and a 10% correction was to follow the 2013 crazy bull market. Similar stories popped-up in August. Therefore, how is it possible to call the shot and aim for the perfect moment to enter a specific stock? Take a wider range and look at the S&P 500 over the past five years:

Where are the great opportunities of February, April and August 2014 on this graph? You are right, they are very small and insignificant. The only truth I see on this graph is the following: once you have selected the right stock, the right moment to buy it is now, time will do the rest.

However, it doesn’t mean that you should buy everything you see because you have some savings aside. There is a valuation work to be done. In order to achieve this task, I will start by looking at how the stock market valued the stock over the past 10 years by looking at its PE ratio:

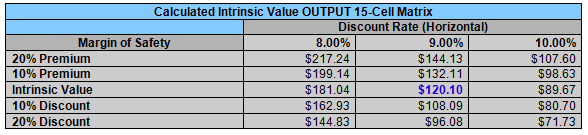

This gives you a good idea of how the stock market value the stock you are looking at. But the PE ratio is not enough. As a dividend growth investor, I also like to consider the value of a company solely based on its dividend perspectives. I use the dividend discount model (DDM) with a double stage dividend growth. The double stage calculation enable me to select a dividend rate for the first ten years (to reflect if I’m bullish or bearish for the short term) and then use another growth rate for the following years.

Here’s an example of valuation calculation with Johnson & Johnson (JNJ):

Principles #1 to #4 cover how to find the right companies. Once you have found them, the sooner you buy the stock, the sooner you start cashing its dividend.

The Rationale Used to Buy is Also Used to Sell

If buying seems complicated, selling stocks is probably worse. I wrote a complete guide around the right time to sell which I will summarize with the following rules:

I never sell a stock because I make X% on it;

I sell a stock because the upside potential has materialized;

I never sell a stock because it is at its highest price ever;

I sell a stock because I don’t see how it will continue to go higher;

I use a stop sell instruction to protect my profit once I’ve decided the stock can’t reliably go higher.

I have explained how I select companies to be part of my portfolio. These are my reasons to buy. Then, if the company doesn’t meet these requirements upon my quarterly review and don’t see how it will get back on track, I simply push the sell button. The reason to buy a stock becomes my reason to sell it. Let me ask you this question: If a stock is up 50% in my portfolio but still shows upside potential, why would I sell it?

The classic example is when a company suspends or cuts its dividend – that’s an immediate sell trigger. Technically, you should get to this extreme by following Dividend Stocks Rock’s dividend growth model. Since we follow revenues, earnings and dividend metrics, we will highlight stocks that with eventually have problem paying their dividend. Each quarter, we review all stocks in our portfolios. We look at their financial results and answer these two questions:

A) Is the company heading towards my expectations (e.g. is the potential being realized or was it just a mirage)?

B) Does the company still show future upside potential (the stock may go up, and still shows it could climb higher)?

When the answer to one of these two questions is a blunt “no”, the sell is triggered.

Finally, my investment decisions are motivated by the fact that the company confirms or infirms my investment thesis. Once the reasons (my investment thesis) why I purchase shares of a company are not valid anymore, I sell and never look back.

Think Core, Think Growth

We have a different way of managing our DSR portfolio compared to the regular “buy & hold” dividend investor. We tend divide our portfolio in two segments: the core portfolio built with strong & stable stocks meeting all our requirements. The second part is called the “dividend growth stock addition” where we may ignore one of the metrics mentioned in principles #1 to #5 for a greater upside potential (e.g. riskier pick as well).

The reason why we has. It’s fairly easy to select a company like Procter & Gamble (PG) since it has been in business forever and has always paid a good dividend. However, picking-up Seagate Technology (STX) after the stock tumbled or Apple (AAPL) when it was going nowhere but started to pay dividends is another story.ve both in our portfolios is to generate higher return.

While the core section is like any other dividend growth portfolio, the addition segment will require closer follow-up. This is the part of our portfolio that will most likely generate the most volatility. Since we don’t have the same risk tolerance, we have divided our portfolios into “conservative” and “growth” models. This means the conservative one won’t likely include the “addition” segment and will concentrate on the core portfolio.

How This Wisdom is Reflected in Dividend Stocks Rock

This resumes the investing principles I use to manage my dividend growth portfolio. In the end, the true power of dividend investing is materialized through time. The longer you keep your dividend growth stocks, the higher the return you will earn from your investments.

Dividend Stocks Rock is an online membership site that give you access to all the tools and techniques you can personally use to build a rock solid portfolio. This is not about stock recommendations or some kind of guru principles. It’s about sound investing decisions made based on solid stock research. And 95% of the work is done for you.

The Dividend Stocks Rock Club will build your knowledge, skills, and investment capability from the ground up. You’ll master the techniques you need to understand what drives portfolio growth and individual stock growth to build the portfolio you want. Most importantly, it will give you the data at your fingertips to allow you to put the process into action from day 1.

01 The Dividend Stocks Rock Core Model Portfolios

The first action you should complete once you register with DSR is to select a portfolio in line with your investment goals. We offer a portfolio for each type of investor. Our portfolios have been built and customized according to 2 priorities: risk profile and size. This is how you can start from a small conservative or growth portfolio with 10 holdings and grow it to 500K account with 30 stocks. Each portfolio comes with a quarterly updated booklet including asset allocation, recent comments on each holding, stock cards and a list of current buy opportunities within the portfolio. All users receive buy & sell email alert when we perform a trade.

02 The Rock Solid Ranking

The second step of your investing journey through DSR should be to screen through our Rock Solid Ranking in the search of your next potential purchase. Companies appearing in our ranking are either closely followed by our team or suggested by other members like you. You will also find all companies included in our DSR portfolios. We rank each company according to their potential upside. Twice a year, we run a dividend discount model (DDM) calculation to complete our analysis of strong dividend growth business. Once a month, we update the current stock price value and calculate the potential upside (+) or downside (-) and publish it on the Rock Solid Ranking. This list is meant to be a tool to quickly identify buy opportunities.

The second step of your investing journey through DSR should be to screen through our Rock Solid Ranking in the search of your next potential purchase. Companies appearing in our ranking are either closely followed by our team or suggested by other members like you. You will also find all companies included in our DSR portfolios. We rank each company according to their potential upside. Twice a year, we run a dividend discount model (DDM) calculation to complete our analysis of strong dividend growth business. Once a month, we update the current stock price value and calculate the potential upside (+) or downside (-) and publish it on the Rock Solid Ranking. This list is meant to be a tool to quickly identify buy opportunities.

03 DSR Stock Cards

As a third step in your investing process, you have access to a comprehensive and efficient stock report library. Each company we review throughout the year is being documented here with a complete analysis for you to read. In a condense pdf format, you can review a company going from their business model, dividend perspectives, risk potentials and finish with a fair valuation. In a glimpse of an eye, you can have a clear idea if this company should be in your portfolio. As a member of DSR, you have the privileged of requesting additional stock cards for those who haven’t been reviewed by our team yet. This “on demand” service is complementary in your subscription. This tool has been especially designed to optimize your precious time toward decision making.

As a third step in your investing process, you have access to a comprehensive and efficient stock report library. Each company we review throughout the year is being documented here with a complete analysis for you to read. In a condense pdf format, you can review a company going from their business model, dividend perspectives, risk potentials and finish with a fair valuation. In a glimpse of an eye, you can have a clear idea if this company should be in your portfolio. As a member of DSR, you have the privileged of requesting additional stock cards for those who haven’t been reviewed by our team yet. This “on demand” service is complementary in your subscription. This tool has been especially designed to optimize your precious time toward decision making.

04 The Dividend Stocks Rock Premium Newsletter

Financial markets evolve rapidly creating waves for your portfolio but also opportunities. Our DSR premium newsletter is being issued twice a month. Our first issue, published on the first Friday of each month concentrates on a specific industry or topic. We go throughout market events and identify the best moves to make. Our second issue, published on the third Friday of each month is an update of our “buy list”. Taken from our Rock Solid Ranking, we explore in depth companies shown as undervalued. As a DSR member, you have access to our complete archive where you can read about our previous trades and industry reviews. This is a real gold mine of information for those who wish to dig deeper before making investment decisions.

Financial markets evolve rapidly creating waves for your portfolio but also opportunities. Our DSR premium newsletter is being issued twice a month. Our first issue, published on the first Friday of each month concentrates on a specific industry or topic. We go throughout market events and identify the best moves to make. Our second issue, published on the third Friday of each month is an update of our “buy list”. Taken from our Rock Solid Ranking, we explore in depth companies shown as undervalued. As a DSR member, you have access to our complete archive where you can read about our previous trades and industry reviews. This is a real gold mine of information for those who wish to dig deeper before making investment decisions.

SO HOW DO YOU GET ACCESS TO DIVIDEND STOCKS ROCK?

We have priced this product for the individual investor! Personally, I am sick and tired of the investment industry fleecing the individual investor and charging outrageous mutual fund fees or brokerage costs because they have “convinced” (read: brainwashed) us into believe we cannot invest on our own. Invest on your own and they say we are destined to a life of poverty!

We want to change that for as many people as possible through sharing this premier investment strategy.This is why we offer three options: our newsletter only registration for smaller budgets, a complete access to our stock lists, rankings, real-time portfolios and our newsletter or the annual package to save 17% on the monthly subscription.

60 Days No Question Asked Reimbursement Policy

The purpose of Dividend Stocks Rock is to provide you with high quality information to help you in your dividend investing process. Our rates are made to be affordable for any investor. This is why Dividend Stocks Rock makes the following guarantees:

60 Days No Question Asked Reimbursement Policy – you can cancel your subscription and get full refund during the first 60 days of your membership

No contracts, cancel any time

Your price will never increase after subscribing

NOTE: The Dividend Stocks Rock is a membership site with access to both online pdfs and online content. This platform does not include stock recommendations please read our terms of use & legal information before proceeding. After you order, you will get INSTANT ACCESS to them. This is not a mailed program.

ClickBank is the retailer of products on this site. CLICKBANK® is a registered trademark of Click Sales, Inc., a Delaware corporation located at 917 S. Lusk Street, Suite 200, Boise Idaho, 83706, USA and used by permission. ClickBank’s role as retailer does not constitute an endorsement, approval or review of these products or any claim, statement or opinion used in promotion of these products.